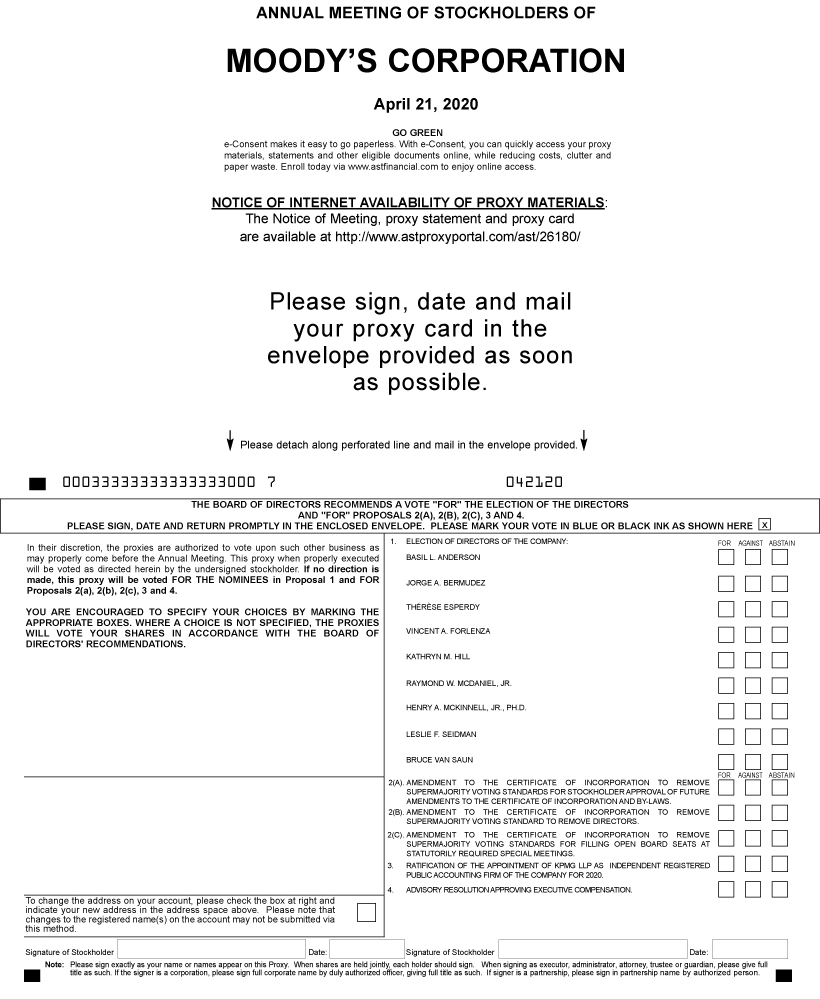

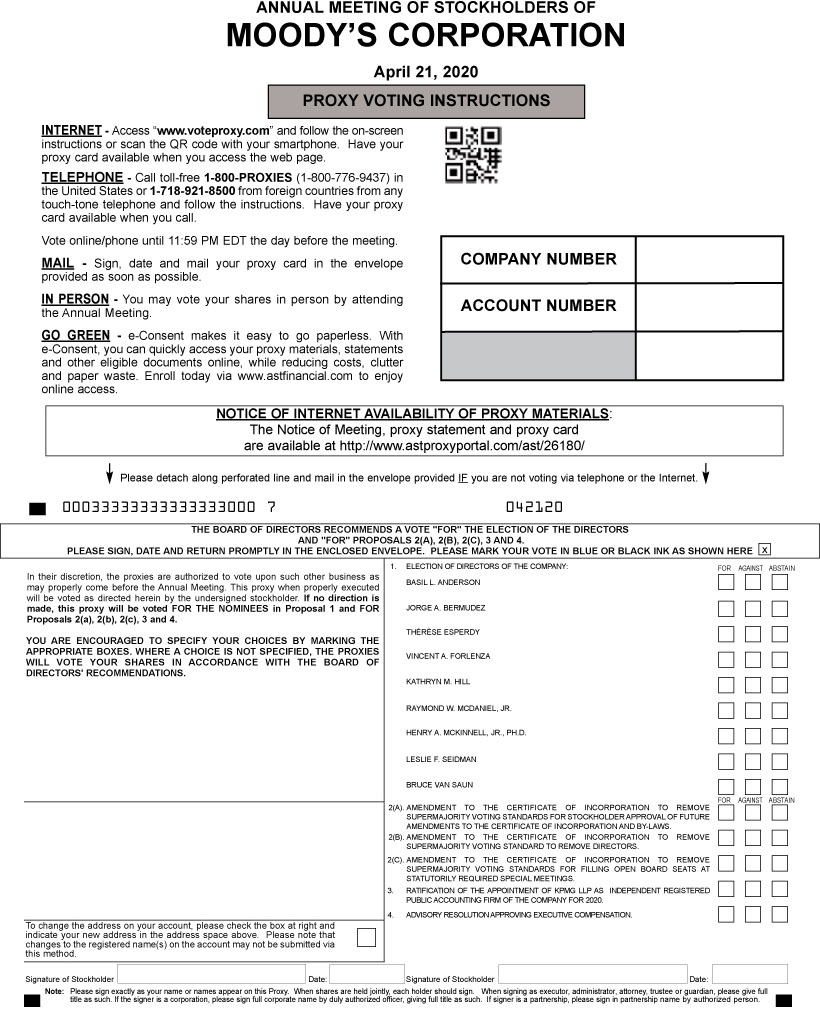

It is not expected that any matter other than those referred to herein will be brought before the Annual Meeting. If, however, other matters are properly presented, the persons named as proxies will vote in accordance with their best judgment with respect to such matters.

Any stockholder of record who votes by telephone or the Internet or who executes and returns a proxy may revoke such proxy or change such vote at any time before it is voted at the Annual Meeting by (i) filing with the Corporate Secretary of the Company at 7 World Trade Center at 250 Greenwich Street, New York, New York 10007, written notice of such revocation, (ii) casting a new vote by telephone or the Internet or by submitting another proxy that is properly signed and bears a later date or (iii) attending the Annual Meeting and voting in person. A stockholder whose shares are owned beneficially through a bank, broker or other nominee should contact that entity to change or revoke a previously given proxy.

Proxies are being solicited hereby on behalf of the Board of Directors. The cost of the proxy solicitation will be borne by the Company, although stockholders who vote by telephone or the Internet may incur telephone or Internet access charges. In addition to solicitation by mail, directors, officers and employees of the Company

may solicit proxies personally or by telephone, telecopy,e-mail or otherwise. Such directors, officers and employees will not be specifically compensated for such services. The Company has retained Georgeson Shareholder Communications Inc. to assist with the solicitation of proxies for a fee not to exceed approximately $15,000, plus reimbursement forout-of-pocket expenses. Arrangements may also be made with custodians, nominees and fiduciaries to forward proxy solicitation materials to the beneficial owners of shares of Common Stock held of record by such custodians, nominees and fiduciaries, and the Company may reimburse such custodians, nominees and fiduciaries for their reasonableout-of-pocket expenses incurred in connection therewith.

Delivery of Documents to Stockholders Sharing an Address

If you are the beneficial owner, but not the record holder, of the Company’s shares, your broker, bank or other nominee may seek to reduce duplicate mailings by delivering only one copy of the Company’s Proxy Statement and Annual Report, or Notice, as applicable, to multiple stockholders who share an address unless that nominee has received contrary instructions from one or more of the stockholders. The Company will deliver promptly, upon written or oral request, a separate copy of the Proxy Statement and Annual Report, or Notice, as applicable, to a stockholder at a shared address to which a single copy of the documents was delivered. A stockholder who wishes to receive a separate copy of the Proxy Statement and Annual Report, or Notice, as applicable, now or in the future, should submit his request to the Company by sending ane-mail toir@moodys.com, by submitting a written request to the Company’s Investor Relations Department, at 7 World Trade Center at 250 Greenwich Street, New York, New York 10007 or contacting the Company’s Investor Relations Department by telephone, at(212) 553-4857. Beneficial owners sharing an address who are receiving multiple copies of the Proxy Statement and Annual Report, or Notice, as applicable, and wish to receive a single copy of such materials in the future should contact their broker, bank or other nominee to request that only a single copy of each document be mailed to all stockholders at the shared address in the future. Please note that if you wish to receive paper proxy materials for the 2017 Annual Meeting, you should follow the instructions contained in the Notice.

CORPORATE GOVERNANCE

In order to address evolving best practices and new regulatory requirements, the Board of Directors reviews its corporate governance practices and the charters for its standing committees at least annually. In April 2016, the Board decided to split the Governance and Compensation Committee into two separate committees: the Governance & Nominating Committee and the Compensation & Human Resources Committee. At that time, the Board adopted new charters for each committee. As a result ofAfter performing its annual governance review for 2016,2019, the Board also amendeddetermined to amend the Company’s Corporate Governance Principles and its charters for the Audit, Governance & Nominating and Compensation & Human Resources and Executive Committee Charters.Committees. A copy of the Corporate Governance Principles is available on the Company’s website atwww.moodys.com under the headings “About Moody’s—Investor Relations—Investor Relations Home—Corporate Governance—Other Governance Documents.” Copies of the charters of the Audit Committee, the Governance & Nominating Committee, the Compensation & Human Resources Committee, the Audit Committee and the Executive Committee are available on the Company’s website at www.moodys.com under the headings “About Moody’s—Investor Relations—Investor Relations Home—Corporate Governance—Charter Documents.” Print copies of the Corporate Governance Principles and the committee charters may also be obtained upon request, addressed to the Corporate Secretary of the Company at 7 World Trade Center at 250 Greenwich Street, New York, New York 10007. The Audit Committee, the Governance & Nominating Committee and the Compensation & Human Resources Committee assist the Board in fulfilling its responsibilities, as described below. The Executive Committee has the authority to exercise the powers of the Board when it is not in session (subject to applicable law, rules and regulations, and the Company’s Restated Certificate of Incorporation andBy-Laws), advises management and performs other duties delegated to it by the Board from time to time.

Board Meetings and CommitteesBOARD MEETINGS AND COMMITTEES

During 2016,2019, the Board of Directors met eight times. Prior to April 12, 2016, the Board had three standing committees: an Audit Committee, a Governance and Compensation Committee and an Executive Committee. As of April 12th, when the Board voted to split the Governance and Compensation Committee, theThe Board had four standing committees: an Audit Committee, a Governance & Nominating Committee, a Compensation & Human Resources Committee and an Executive Committee. All incumbent directors attended at least 83% percentmore than 80% of the total number of meetings of the Board and of all Board committees of the Board on which they served in 2016 (held during the period that they served).

References throughout this Proxy Statement to the “Governance and Compensation Committee” relate to actions that such former committee took in advance of it being split into two committees. For instance, compensation decisions made in December 2015 and February 2016 were made by this former committee.2019.

Please refer to page 1011 for additional information regarding the Audit Committee, and to page 1213 for additional information regarding the Governance & Nominating Committee and page 13 for additional information regarding the Compensation & Human Resources Committee. The Executive Committee did not meet in 2016.

2019. Directors are encouraged to attend the Annual Meeting. All ofindividuals elected to the individuals serving as directorsBoard at the timeCompany’s 2019 annual meeting of the Company’s 2016 Annual Meetingstockholders attended the meeting.

Recommendation of Director CandidatesRECOMMENDATION OF DIRECTOR CANDIDATES

The Governance & Nominating Committee considers and makes recommendations to the Board regarding the size, structure, composition and functioning of the Board and engages in succession planning for the Board and key leadership roles on the Board and its committees. The Governance & Nominating Committee is also responsible for overseeing the processes for the selection and nomination of director candidates,candidates. The Governance & Nominating Committee periodically reviews the skills, experience, characteristics and other criteria for developing, recommendingidentifying and evaluating directors, and recommends these criteria to the Board for approval, and periodically reviewing Board membership criteria.Board. The Governance & Nominating Committee will consider director candidates recommended by stockholders of the Company.Company and may also engage independent search firms from time to time to assist in identifying and evaluating potential director candidates. In considering a candidate for Board membership, whether proposed by stockholders or otherwise, the Governance & Nominating Committee examines the candidate’s business experience, qualifications, attributes and skills relevant to the management and oversight of the Company’s business, independence, the ability to represent diverse stockholder interests, judgment, integrity, the ability to commit sufficient time and attention to Board activities, and the absence of any potential conflicts with the Company’s business and interests. The Committee also seeks diverse occupational and personal backgrounds for the Board. See “Qualifications and Skills of Directors” on page 1718 and “Director Nominees” beginning on page 19 for additional information on the Company’s directors. To have a candidate considered by the Governance & Nominating Committee, a stockholder must submit the recommendation in writing and must include the following information:

The name of the stockholder and evidence of the stockholder’s ownership of Company stock, including the number of shares owned and the length of time of ownership; and

The name of the candidate, the candidate’s resume or a listing of his or her qualifications to be a director of the Company, and the candidate’s consent to be named as a director if selected by the Governance & Nominating Committee and nominated by the Board.

| | | | |

| | MOODY’S2020 PROXY STATEMENT | | 5 |